India was Australia’s 4th largest export destination for its goods and 5th largest trading partner in goods and services in 2010-11.

Australia was India’s eighth biggest trading partner in the year 2010-11.

Bilateral trade in goods : A$ 17.82 bn. (US$17.66 bn.) (2010-11)*

India's Exports : A$ 2.08 bn. (US$2.05 bn.) (2010-11)*

India's Imports : A$ 15.74 bn. (US$ 15.58 bn.) (2010-11)*

Main exports : Pearls & gems, Rotating electric plants, Jewellery Made-up textiles, and Medicaments (incl. veterinary).

Main imports : Coal, non-monetary gold, copper and copper ores, Crude Petroleum, Fertilizers (excl. crudes) etc.

Bilateral trade in services :A$ 3.19 bn. (US$ 3.15 bn.) (2010-11)

India's Service Exports : A$0.69 bn. (US$ 0.68 bn.) (2010-11)

India's Service Imports : A$ 2.5 bn. (US$ 2.47 bn.) (2010-11)

Australia's main export destinations : Japan, China, RoK, India, U.S.A.

Australia's main import sources : China, USA, Japan, Singapore, Germany.

TRADE

India’s Imports from Australia:

Three products – coal, non monetary gold and copper ores – account for over 86 percent of India’s imports from Australia, with coal being the dominant import.

India is Australia’s largest export market for gold and chickpeas, second largest market for coal and copper ores, third largest market for lead and wool, and a growing market for nickel exports.

Main Australian service exports to India are Education; education – related travel; tourism.

Main Indian service exports are Computer & information services; tourism.

The average rate of growth has been 22.6% over the past five years.

India’s Exports to Australia:

India currently ranks as the 21st largest exporter to Australia. India’s exports in goods to Australia were A$2.08 billion in 2010-11. In comparison to the Indian imports from Australia, India’s exports have been small, the balance of trade is heavily in favor of Australia.

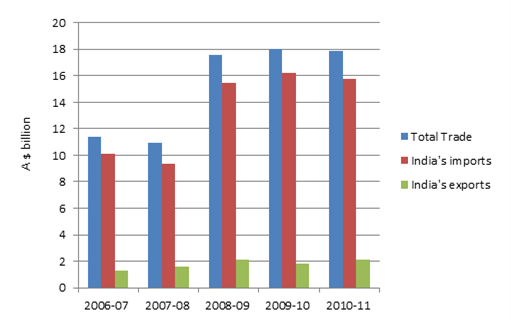

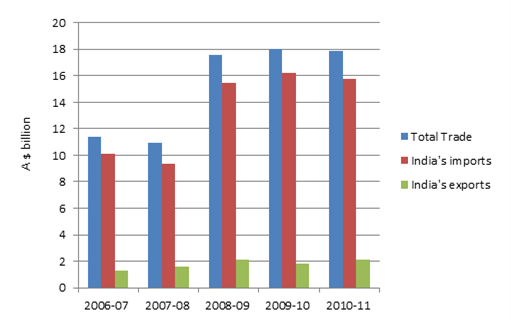

INDIA – AUSTRALIA TRADE IN GOODS: 2005 - 2011

(all figures in A$)

Year* |

2005 - 06 |

2006 - 07 |

2007 - 08 |

2008 – 09 |

2009 - 10 |

2010 - 11 |

Total trade |

$10.12 bn. |

$10.75 bn. |

$10.92 bn. |

$17.53 bn. |

$18.02 bn. |

$17.82 bn. |

India’s Exports |

$1.28 bn. |

$1.46 bn. |

$1.60 bn. |

$2.11 bn. |

$1.84 bn. |

$2.08 bn. |

India’s Imports |

$8.84 bn. |

$9.29 bn. |

$9.32 bn. |

$15.42 bn. |

$16.17 bn. |

$15.74 bn. |

(all figures in A$)

INDIAN BUSINESS IN AUSTRALIA:

Government of India offices and PSUs in Australia include Government of India Tourist Office; State Bank of India branch office (since April 2004); Representative Offices of Bank of Baroda; Union Bank of India and Panjab National Bank; New India Assurance Co Ltd (has a presence in Australia since 1955); and Air India (offline station).

All the major Indian IT companies have a presence in Australia. These include Infosys; Satyam; TCS; HCL; Polaris Software Lab Ltd; Birlasoft; NIIT; 3i Infotech Asia Pacific; Wipro; Tech Mahindra ; Tata Communications; Zensar Technologies; i-Flex; igate; among others. Infosys, Satyam, TCS, Birlasoft and HCL have established Software Development Centres in either Sydney or Melbourne. Polaris has a Performance Diagnostics and Managed Testing Services in Sydney. Infosys has acquired Portland Group, a sourcing and category management services firm in Australia for A$ 37 million. A Chapter of NASSCOM is also established in Sydney.

Major Indian investments in Australia include that by India’s Oswal Group (ammonia plant at Karratha close to North-West Shelf project in the State of Western Australia); Sterlite Industries (two copper mines in the State of Tasmania in Mt Lyell and a copper/gold mine in the State of Queensland at Charters Towers); Aditya Birla Group [copper mines at Nifty (Western Australia) and Mt Gordon (Queensland)]; Gujarat NRE Coke has a coal mines in New South Wales.

In Aug. 2010, Adani Enterprises, India’s biggest coal importer, reached an agreement to buy one of Linc Energy’s Queenslnd coal permits for $ 500 million plus royalties. Linc has sold its Galilee Basin coal deposits to the Adani Group in a deal worth up to $ 3 billion over 20 years. Linkc’s Galilee tenement is about 100 km north of Alpha in central Queensland. The deal has already been approved by the Foreign Investment Review Board and the Queensland Government has also indicated it would approve the transfer of the coal tenement. It is expected that Adani would begin producing thermal coal from the site from 2014.

Adani Enterprises’ through its company Mundra Port and Special Economic Zone has acquired the rights to manage the Abbot Point coal loading terminal for a period of 99 years bidding A$ 1.829 billion. The government will retain ownership of the land and jetty with Adani to operate the terminal. Abbot Point coal terminal, which is a crucial export hub for coal from the Bowen and Galilee basins, will soon have a capacity for 50 milliion tonnes a year.

Major Indian petroleum explorer, Bharat PetroResources Ltd (BPRL) and Norwest Energy agreed to a farm-in (exploration investment agreement) of two of Norwest’s Perth Basin permits (EP413 and TP/15). Up to $10 million will be invested by BPRL towards drilling and testing programs to evaluate the shale gas potential of EP413, earning the company 50 per cent of Norwest’s interest.

Indian power giant Lanco Infratech made a large investment in Australia, spending almost A$ 850 million to buy the coal assets of Ric Stowe’s failed Griffin Group and unveiling plans to triple the export capacity of the mines. The Hyderabad-based group may also enter the bidding- along with Chinese, Japanese and American companies – for Griffin’s Bluewaters power stations in Western Australia.

Tata Steel has a presence in Brisbane. Tata Power has a stake in Geodynamics Ltd a geothermal energy company. The Taj Group of Hotels acquired the W Hotel in Sydney renamed – Hotel “Blue”. Visa International (Visa Steel) has an office and a mine in Queensland.

RIL Australia Pty Limited (RILA), a subsidiary of Reliance Industries Limited has a Joint Venture agreement with Uranium Exploration Australia Limited to participate in the Australian energy sector including uranium exploration and mining. A tractor division of Mahindra & Mahindra Limited is based in Brisbane. A new venture called Mahindra Automotive Australia (MAU) has also been established.

Tata Power and Australian company Geodynamics have entered into an agreement involving Tata Power taking an 11.4 per cent stake in Geodynamics for A$ 44.1 million and a seat on its Board. Tatas have enhanced their investment in a mining joint venture (led by Vale of Brazil) in Queensland.

Petronet LNG Limited, New Delhi signed an agreement with ExxonMobile on 10 August 2009 to source 1.5 mmtpa of LNG from its share of Gorgon Project, for 20 years starting from 2014.

On 11 September 2009, Riverina Oils & Bio Energy, a joint venture with the Bhoruka Group, held the ground breaking ceremony for their A$ 63 million project on a 170,000 tonnes a year oil seed crushing and edible oil refining plant at Wagga Wagga, NSW.

Adani Enterprises, India’s biggest coal importer, has reached an agreement to buy one of Linc Energy’s Queenslnd coal permits for $ 500 million plus royalties. Linc has sold its Galilee Basin coal deposits to the Adani Group in a deal worth up to $ 3 billion over 20 years. Linkc’s Galilee tenement is about 100 km north of Alpha in central Queensland. The deal has already been approved by the Foreign Investment Review Board and the Queensland Government has also indicated it would approve the transfer of the coal tenement. It is expected that Adani would begin producing thermal coal from the site from 2014.

Adani Enterprises, through its subsidiary, Mudra Port and Special Economic Zone has acquired rights to manage the Abbot Point Coal loading terminal for a period of 99 years at a cost of A$ 1.83 billion. Abbot Point Coal terminal is a crucial export hub for coal transport from the Bowen and Galilee basins in Queensland.

GVK Power and Infrastructure has finalised the purchase of two thermal coal mines from Australia’s Hancock Prospecting for about US$ 2.4 billion and is also investing in development of rail network from the mine to the nearest port, which entails a total investment of U$10 bn.

NMDC has concluded the purchase of half stake in Perth based Legacy Iron Ore in September 2011 and is conducting due diligence for the purchase of the Ridley magnetite project of Atlas Iron Ore.

IFFCO and Legend Holdings of Australia have entered into an agreement involving investment of over A$ 100 mn by IFFCO in Legend’s phosphate projects with buyback arrangements, and IFFCO Chairman and another nominee joining the Board of Legend. NMDC and Rio Tinto entered into an agreement for joint exploration in India, Australia and other countries.

Other companies, with interests in Australia, include Suzlon Energy; Sundaram Infotech Solutions Ltd; Firepro Systems; Sumi Motherson Group, ITC; Ashok Minda Group; Bhushan Steel Ltd; Indage Holdings Ltd and Security and Intelligence Services (India) limited among others.

AUSTRALIAN BUSINESS IN INDIA:

The total value of Australian investments in India during the period April 2000 to September 2008 was Rs 9,983.5 million ( US$ 226.02 million). This accounts for 0.31 % of the total approved investment in India from all countries and sources.

The top sectors attracting FDI inflows (from January 2000 to December 2007) from Australia were Metallurgical industries, Services Sector (financial and insurance) , Telecommunications , Consultancy Services and Hotel & Tourism in that order.

Australia has been granted 160 technical collaborations or 2.01 % of the overall total technical collaborations since 1991.

Some of the major Australian companies which have presence in India include Telstra (telecommunications); BHP Billiton (mining); Rio Tinto (mining); MIM Holdings (mining); Snowy Mountains Engineering Corporation (infrastructure development); AWB (formerly Australian Wheat Board) Argyle diamonds (technical support office for diamond sales); P & O Australia (development of container ports); Clough Engineering (port development); Orica Limited (joint venture with Imperial Chemical Industries); Lucent Technologies (IT); ANZ (IT); Fosters (brewery); Boral Ltd; Qantas (Airlines);

Other companies include:

TNT Express (courier services); Village Roadshow (entertainment); Cookie Man (biscuits); Faber Castell (stationery products); Futuris brakes; Minter Elison (legal services); Narrowcasters (simultaneous interpretation in Museums in Mumbai, Delhi and Jodhpur); Mayne Group (pharmaceuticals); Sigma (pharmaceuticals); among others.

Recent entrants include Macquarie Group (infrastructure); Blue scope steel; L J Hooker (property development); Leighton Holding (property development); Axa Asia Pacific (joint venture agreement with Bharti Telecoms Group for Insurance); Woolworths (retail and IT opportunities with Tata Sons and TCS); among others.

ANZ Banking Group opened its first branch in Mumbai in June 2011 to support trade and investment flows between India and Australia and will serve corporate and institutional clients.

India - Australia Joint Ministerial Commission & India - Australia FTA

The India-Australia Joint Ministerial Commission was established in 1989 and has held thirteen meetings to date, last one in Canberra on 12 May 2011. The Indian delegation for the JMC was led by Shri Anand Sharma, Minister for Commerce & Industry. At the conclusion of the JMC, the two sides agreed to commence negotiations for a Comprehensive Economic Cooperation Agreement (CECA). India and Australia also announced formal launching of the CEO Forum with Mr. Navin Jindal, MP as co-chair on the Indian side and Mr. Lindsay Fox as co-chair on the Australian side. Two rounds of CECA negotiations were held in 2011.

OPPORTUNITIES

Potential for Indo-Australian cooperation exists in infrastructure development including roads, ports, airports and railways; power sector; mining; oil and natural gas including LNG; biotechnology; drugs and pharmaceuticals; information technology; water management, soil conservation and waste disposal; food processing and agribusiness; film and television; processing of gems and jewellery; tourism; and education.